Selling parents’ house before death in Estero, Florida, can be a complex and emotional process, but it’s an important step for many families seeking to manage their parents’ estates effectively. Estero presents a distinctive real estate market characterized by its vibrant community and scenic views, demanding thoughtful consideration and informed decision-making. This blog will provide key tips and insights into selling parents’ house before death in Estero, guiding you through the process swiftly and confidently while honoring your family’s needs and wishes.

When considering selling your parents’ house before death in Estero, Florida, exploring options with experienced real estate investors like Steve Daria and Joleigh, who specialize in purchasing homes for cash, is beneficial. Their expertise in the local market offers invaluable insights and simplifies the selling process, ensuring a swift and efficient sale that meets your family’s needs. Selecting professionals such as Steve and Joleigh guarantees a fair cash offer and the assurance of dealing with reputable buyers.

The Concept of Selling a Parent’s House Before Death

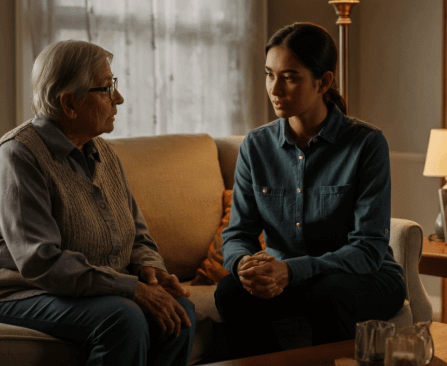

When we discuss selling a parent’s house before their death, we’re referring to the process of transferring ownership of the property while the parent is still alive.

This decision can be caused by various factors such as financial needs, downsizing, or simplifying estate planning.

Being aware of the implications of such a decision is crucial, as it involves financial, emotional, and legal considerations.

Why Consider Selling a Parent’s House Before Death?

- Access to Funds: Selling the property can provide much-needed funds for medical care, living expenses, or other financial obligations.

- Avoiding Inheritance Taxes: Early sale can potentially reduce the complexity of estate taxes, depending on how the sale is structured.

- Avoiding Probate: Handling the property sale while the parent is alive can help avoid the probate process, which can be time-consuming and costly.

- Parent Involvement: This approach allows parents to be part of the decision-making process, ensuring their preferences and wishes are honored.

- Sense of Control: Selling the house before death can provide a sense of control and closure for the family.

- Preparation for the Future: This process allows families to plan and make decisions collectively, which can reduce stress during an already difficult time.

Get An Offer Today, Sell In A Matter Of Days

Key Strategies for Selling a Parent’s House Before Death

Explore effective strategies for smoothly and successfully managing the sale of a parent’s home prior to their passing in Estero, Florida.

Open Communication

Effective communication is important when dealing with the sale of a parent’s house.

Ensuring that all family members are on the same page can help prevent misunderstandings and conflicts.

- Discuss Reasons: Clearly explain the reasons for selling and how it will benefit everyone involved.

- Address Concerns: Be open to discussing any concerns or preferences family members may have.

Involving Professionals

Hiring experts can facilitate a smoother and more efficient sales process.

Professional backing ensures that all components of the sale are handled correctly.

- Real Estate Agents: They provide valuable insights on market conditions, pricing, and marketing strategies.

- Attorneys: They handle legal requirements, including drafting necessary documents and ensuring compliance with laws.

- Financial Advisors: They offer advice on the financial implications of the sale and help with tax planning.

Assessing the Property’s Value

Accurate property valuation is crucial for setting a fair asking price and ensuring a successful sale.

- Professional Appraisal: Obtain a professional appraisal to determine the market value of the property.

- Market Research: Compare the same properties in the area to gauge a competitive asking price.

Legal Considerations When Selling a Parent’s House Before Death in Estero, Florida

When planning to sell a parent’s house before their passing, it is crucial to explore the legal requirements and potential challenges to ensure compliance and facilitate a seamless transaction.

Power of Attorney

If the parent is unable to manage the sale themselves, a power of attorney (POA) allows someone to act on their behalf.

- Authority: POA grants the designated individual the authority to make decisions about the property.

- Smooth Process: This ensures that the sale can proceed without delays or legal issues.

Joint Ownership

Joint ownership is another option where the property is owned by both the parent and another party, such as a child.

- Simplified Transfer: This can make the transfer process smoother and may offer certain tax advantages.

- Legal Implications: Be aware of the potential risks and legal implications associated with joint ownership.

Estate Taxes

Understanding how estate taxes affect the sale is crucial for minimizing tax liabilities.

- Tax Impact: Selling the property before death can help reduce estate taxes, depending on how the sale is structured.

- Consult a Specialist: Work with a tax specialist to understand how to optimize the sale for tax benefits.

Essential Tips for a Successful Sale

Employing effective strategies can significantly boost both the efficiency and success of selling parents’ house before death in Estero.

Preparing the House for Sale

Proper preparation can enhance the property’s appeal and potentially increase its selling price.

- Declutter: Remove unnecessary items to make the house more appealing to buyers.

- Repairs: Address any necessary repairs to improve the property’s condition.

- Staging: Stage the house to highlight its best features and create a welcoming environment.

Marketing the Property

Effective marketing techniques can attract potential buyers and expedite the sale process.

- Online Listings: Utilize real estate websites and platforms to reach a broad audience.

- Open Houses: Host open houses to display the property to interested buyers.

- Social Media: Leverage social media to increase visibility and attract potential buyers.

Negotiating Offers

When offers come in, evaluate each one carefully to ensure it meets your family’s financial and personal objectives.

- Offer Price: Consider the offer price and compare it to your expectations.

- Terms and Conditions: Review the terms and conditions of each offer, including contingencies and closing dates.

- Effective Negotiation: Negotiate effectively to secure the best possible deal for your family.

Conclusion

Selling parents’ house before death in Estero, Florida, is a remarkable decision that needs careful planning and consideration. By understanding the financial, legal, and emotional aspects, families can make informed choices that benefit everyone involved. Ensuring a seamless and successful sale relies on open communication, professional support, and comprehensive preparation.

**NOTICE: Please note that the content presented in this post is intended solely for informational and educational purposes. It should not be construed as legal or financial advice or relied upon as a replacement for consultation with a qualified attorney or CPA. For specific guidance on legal or financial matters, readers are encouraged to seek professional assistance from an attorney, CPA, or other appropriate professional regarding the subject matter.