In today’s uncertain economic climate, many Lehigh Acres homeowners may ask, “Can I give my house back to the bank?” This blog addresses this pressing question and explores the options available to homeowners who feel overwhelmed by their mortgage obligations. Understanding whether you can give your house back to the bank without the damaging consequences of foreclosure is crucial for making informed decisions that could impact your financial future. Join us as we delve into this topic’s intricacies and clarify the question, “Can I give my house back to the bank?” while offering guidance on navigating this challenging situation.

Steve Daria and Joleigh, seasoned real estate investors, understand homeowners’ complexities when considering whether to give their house back to the bank. They have helped numerous clients explore viable alternatives to foreclosure, emphasizing the importance of proactive communication with lenders. By leveraging their expertise, homeowners in Lehigh Acres can find tailored solutions that may alleviate financial stress and preserve their creditworthiness.

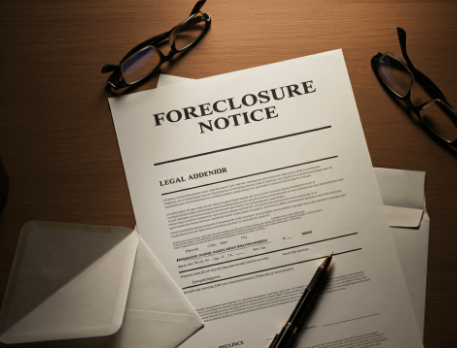

Understanding Foreclosure

Foreclosure is a legal method initiated by a lender when a borrower fails to make mortgage payments, resulting in default on the loan.

The lender seeks to take back the outstanding loan balance by obliging the sale of the property that was used as collateral.

Usually, the property is sold at a public auction, often at a price below its market value, leading to financial loss for the borrower.

Key Consequences of Foreclosure

- Financial Loss: The sale usually occurs at a lower price, resulting in financial loss for the borrower.

- Credit Damage: Foreclosure can notably damage your credit score, making it harder to get loans later.

- Long-Term Impact: The long-term effects of foreclosure can hinder your ability to purchase another home and may impact your overall financial stability.

Impact on Your Credit Score

Foreclosure can remain on your credit profile for up to seven years, significantly affecting your ability to secure future loans, rent properties, or even obtain certain jobs.

It’s crucial to explore alternatives to foreclosure if you’re struggling to keep up with mortgage payments.

Emotional and Social Consequences

Foreclosure not only impacts your finances but also your emotional and social well-being.

The stigma associated with foreclosure can strain personal relationships and negatively affect your mental health.

Get An Offer Today, Sell In A Matter Of Days

Alternatives to Foreclosure

Fortunately, there are several alternatives to foreclosure that can help you address your financial difficulties while minimizing the negative impact on your credit.

Loan Modification

Loan modification involves modifying the terms of your mortgage to ensure payments are easier to manage.

This may include extending the loan term, adjusting the interest rate, or even reducing the principal balance.

This option allows you to remain in your home while making payments more affordable.

Short Sale

A short sale occurs when you sell your house for less than the remaining balance, with the lender’s approval.

While a short sale will influence your credit score, it is generally less damaging than a foreclosure.

Deed in Lieu of Foreclosure

This is a legal agreement where you voluntarily pass on the ownership of your property to the lender.

In return, the lender releases you from the mortgage obligations.

This choice can help you avoid the lengthy and costly foreclosure process.

Key benefits:

- Avoid Foreclosure: This method helps you avoid the public record and stigma associated with foreclosure.

- Credit Score Impact: While it will affect your credit score, the impact is generally less severe than a foreclosure.

- Move Out on Your Terms: You can negotiate a timeline that gives you adequate time to relocate.

Steps to Take for Giving House to The Bank

Can I give my house back to the bank? Here are the essential steps to take:

- Contact Your Lender: Contact your lender to indicate your interest in a deed in lieu of foreclosure. Clearly explain your financial situation and request information on how to proceed.

- Document Submission: Submit the required documents to your lender, including financial statements and a hardship letter explaining your situation. This helps the lender assess your request.

- Property Appraisal: The lender will perform an appraisal to identify the property’s current market value. This helps in assessing whether the deed in lieu of foreclosure should be approved.

- Approval and Agreement: Once the lender reviews and approves your request, both parties will sign the agreement, transferring the deed of the property to the bank.

Strategies for a Successful Transition

Can I give my house back to the bank? Here’s what you can do for a successful transition:

- Financial Planning: Make a financial plan to manage your expenses during and after the transition. This includes budgeting for moving costs, rental deposits, and other immediate needs.

- Consult a Real Estate Expert: Real estate experts can help you understand your choices, negotiate with lenders, and ensure all paperwork is handled correctly.

- Legal Considerations: Consulting a legal advisor can assist in arranging the terms of the deed in lieu of foreclosure settlement and ensure all legal aspects are covered.

Tips for Communicating with Your Lender

Here’s how you can communicate with your lender:

- Be Transparent: Honesty is vital when discussing your financial situation with your lender. Provide accurate information and be upfront about your inability to make mortgage payments.

- Offer Solutions: Present potential solutions, such as a deed in lieu of foreclosure, to show the lender that you are proactively addressing the situation.

- Keep Records: Document all communications with your lender, including emails, phone calls, and letters. This record-keeping can be beneficial if disputes arise during the process.

Conclusion

Navigating the complexities of the question, “Can I give my house back to the bank in Lehigh Acres without facing foreclosure?” can be challenging. However, understanding your options—such as loan modifications, short sales, or deeds in lieu of foreclosure—can help you make informed decisions.

By proactively communicating with your lender and consulting experts and planning your financial future, you can alleviate the adverse impacts on your credit score and overall well-being.

**NOTICE: Please note that the content presented in this post is intended solely for informational and educational purposes. It should not be construed as legal or financial advice or relied upon as a replacement for consultation with a qualified attorney or CPA. For specific guidance on legal or financial matters, readers are encouraged to seek professional assistance from an attorney, CPA, or other appropriate professional regarding the subject matter.